pesdescalcos.blog.br

pesdescalcos.blog.br

4 Budgeting Tips For Single Women

It has taken me a while but I’ve finally done it! I’ve become financially stable. Maybe that isn’t something that I should be exclaiming from the mountain tops – I mean, I am 33 after all. Growing up, I figured I’d be comfortable way before I reached my 30’s, but life doesn’t always go as we expect, right?

As a single woman, I have reached a point in my life that I am no longer living paycheck to paycheck and while I still have outstanding bills that need to be paid off, things are a lot less stressful. For as long as I can remember, “budgeting” was always on my to-do list, and while I didn’t frivolously spend every penny I made, I wasn’t always as nice to my creditors as I should have been.

Budgeting always sounded like such a complicated and time-consuming chore, but I’ve finally realized that budgeting does not have to be difficult. In fact, it might even be fun if you find the right process! So here are a few simple budgeting tips that helped me – hopefully they help you as well.

1. Break it down

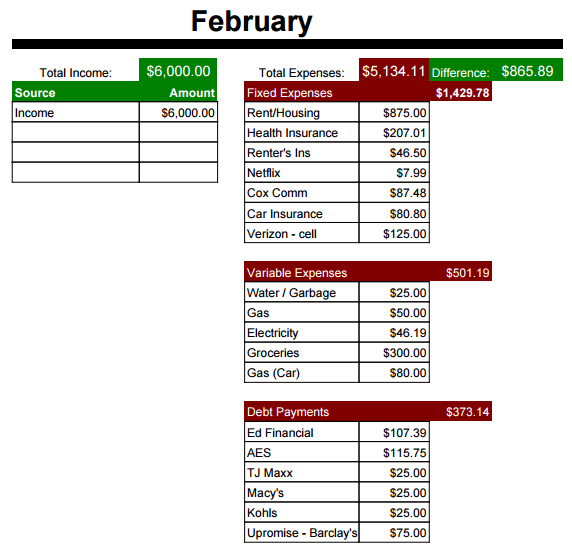

To start, you will want to keep track of all of the money you have coming in, and all of the money you have going out. Find a tracking method that works for you – whether it’s a budget that you write down on paper (what, people still write things on paper?!), a spreadsheet (like this one), or even an app on your phone. Your budget breakdown should start with the following sections:

- Fixed Expenses: Rent, insurance, car payment, etc.

- Variable Expenses: Utilities, groceries, gas, etc.

- Debt Payments: Credit cards, etc.

- Savings/Interest – 401K, IRA, savings accounts, etc.

- Other: Anything that may not fall into the other four categories. For example, if you’re self-employed, you’ll want to track estimated taxes.

Your subcategories will differ depending on what you actually spend your money on, and remember, you want to keep track of every. single. penny.

So include a sub category for “eating out” or even just a “Misc” subcategory, although I have found that throwing everything into a Misc subcategory kind of defeats the purpose of keeping track because you don’t really know what expense are being included (unless you itemize them somewhere).

You can get this template here!

You can get this template here!

2. Track Spending

Once you start budgeting, you become painfully aware of what you spend your money on. All of those trips to Starbucks and ‘quick’ lunches add up, so maybe it’s time to make a few changes. Instead of picking up coffee every morning (afternoon or night), start making your own at home. There are all kinds of cool coffee makers that you can get, most you can set and forget! Start planning your meals for the week, which can sound daunting in itself, but it is definitely helpful down the road. Remember that Misc subcategory I mentioned earlier, while it is easier to see just one number in a spreadsheet, it doesn’t really help you much when you don’t really know what is all being added up.

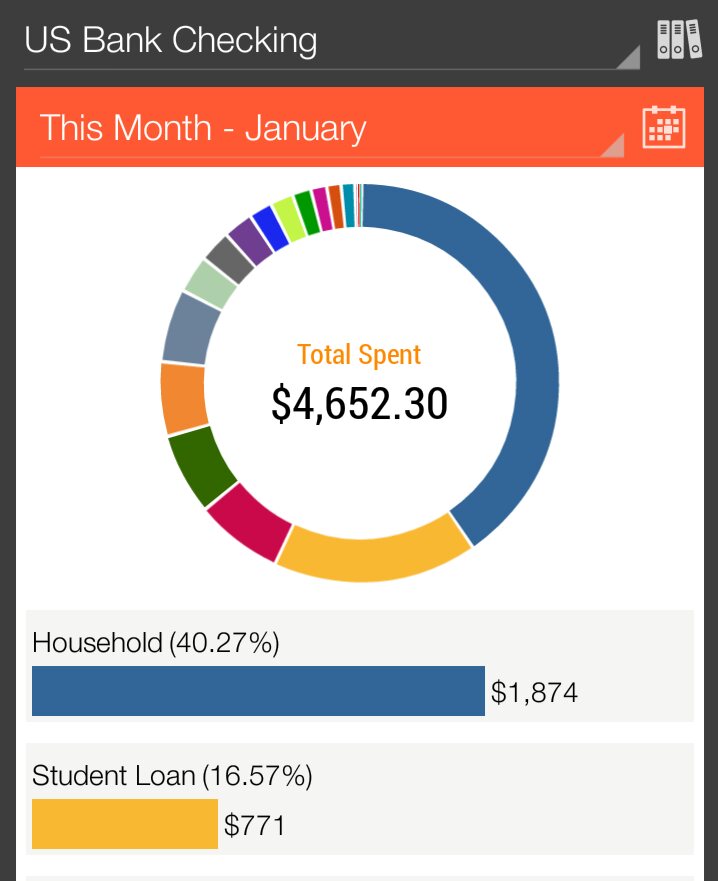

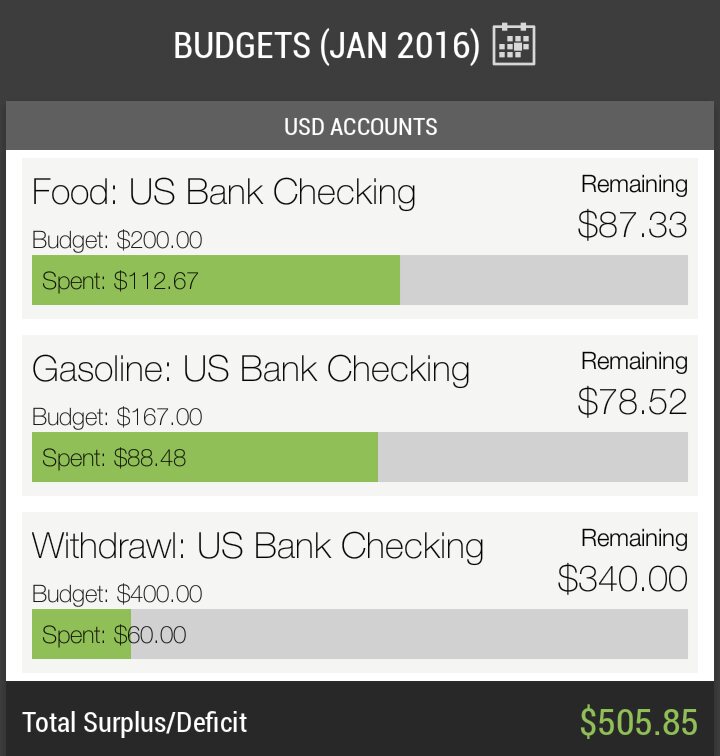

I would recommend using an app so that you can easily enter transactions when they happen. Here’s a list of different apps that you can use, if you decide to go that route. The other plus side to this is that you can view your spending in graphs and charts, if you’re into that kind of thing.

More specifically you can create budgets within the apps, so when you are about to reach your max you receive a notification of some kind. You can do this online or on paper as well, I suppose, but I think it would be more work versus an app pulling all of the data for you.

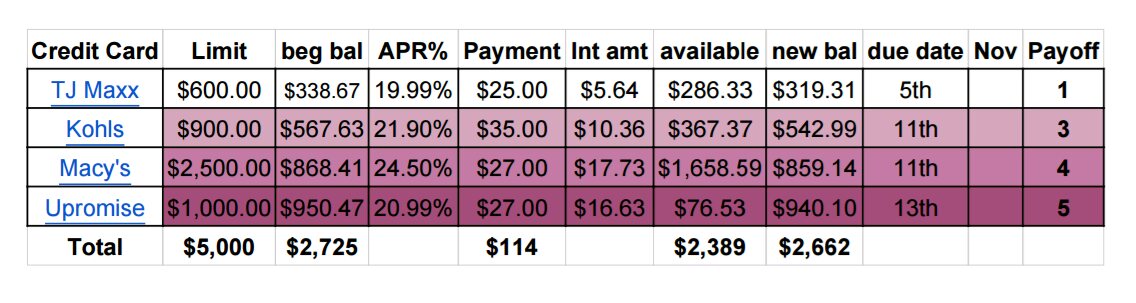

3. Pay off debt

It is a known fact that if you only make the minimum payment on your credit cards you will be throwing away money (ahem, interest!), so don’t do that! There are all kinds of ways that you can pay off debt, whether you pay off high interest cards first or go with the one that has the lowest balance, just figure out which would best fit your financial situation. In an effort to have everything in one spot I have added a tab in my budget that has all of my credit card information listed. Using that I can plan out how things will be paid off, and when. I sort everything by the beginning balance and use that to determine who will get my money first. There was a point where I was only making the minimum payments, and if you read through your credit card agreement you can check out the estimated payoff date… which is usually more than a few years away. Needless to say, you’ll also be paying way, way more than you initially borrowed, so do yourself a favor, and pay that shiz off ASAP! Your bank account will thank you later (see #4)!

I sort everything by the beginning balance and use that to determine who will get my money first. There was a point where I was only making the minimum payments, and if you read through your credit card agreement you can check out the estimated payoff date… which is usually more than a few years away. Needless to say, you’ll also be paying way, way more than you initially borrowed, so do yourself a favor, and pay that shiz off ASAP! Your bank account will thank you later (see #4)!

Note: It is a good idea to have at least one credit card (or revolving account) so that you can build up your credit, but always be mindful of what you are using it for, and make sure you pay off the balance each month.

4. Plan for the future

I personally include a “Savings/Interest” category where I keep track of money going into my personal retirement fund and money going into a small savings account. I have always been told that I should be putting 10% of my paycheck into some kind of retirement savings, and there are all kinds of resources online that will help you figure out what kind of retirement fund is best for your needs. If you are lucky enough to work for a company that will automatically deduct that money from your paycheck, then you’re set to go – even more so if your company matches contributions!

As a consultant, I do not have that luxury so I have to take the money out myself, which admittedly was hard when I first started out. I have slowly started to save money; I started out by taking 5% of my paycheck and putting that into an IRA account that I set up for myself through Vanguard. As time went on I was able to increase the contribution to 10%, and I am optimistic that I can increase that again as time goes on.

A couple of ways to save that I have read about and thought about doing myself:

- Get into the habit of shopping online. Determine whether or not this is an item that you need or want. If it isn’t a need then take it out of your cart and instead, throw the money into a savings account. You were going to spend the money anyway, right? This way you have it saved up for a rainy day.

- If you are big into online shopping you can also sign up for sites like Ebates and earn cash back!

- Use tools. Apps like Acorns lets you round transactions up to the dollar, once you reach a certain amount you can then invest it.

- Use a good, old-fashioned piggy bank. Whether you’re doing the “Penny a Day” or “52 Week Money” challenge, or just get into the habit of putting bills into a jar, sometimes it’s easier to just have cash on hand. When I was young, I would hide singles in between the pages of my books. Just be careful not to lend anyone the books you’re using otherwise they might get a nice surprise.

And there you have it! Budgeting doesn’t have to be hard, at all. Obviously it can get more complicated if you have more debits/credits coming out of your account, or have multiple accounts to keep track of, but it doesn’t have to be hard. I hope that you can use some of these simple budgeting tips to either help you pay off debt, save, or just make your day-to-day life a bit less stressful.

Do you have any simple budgeting tips or app suggestions that we can include in our budgeting plan?